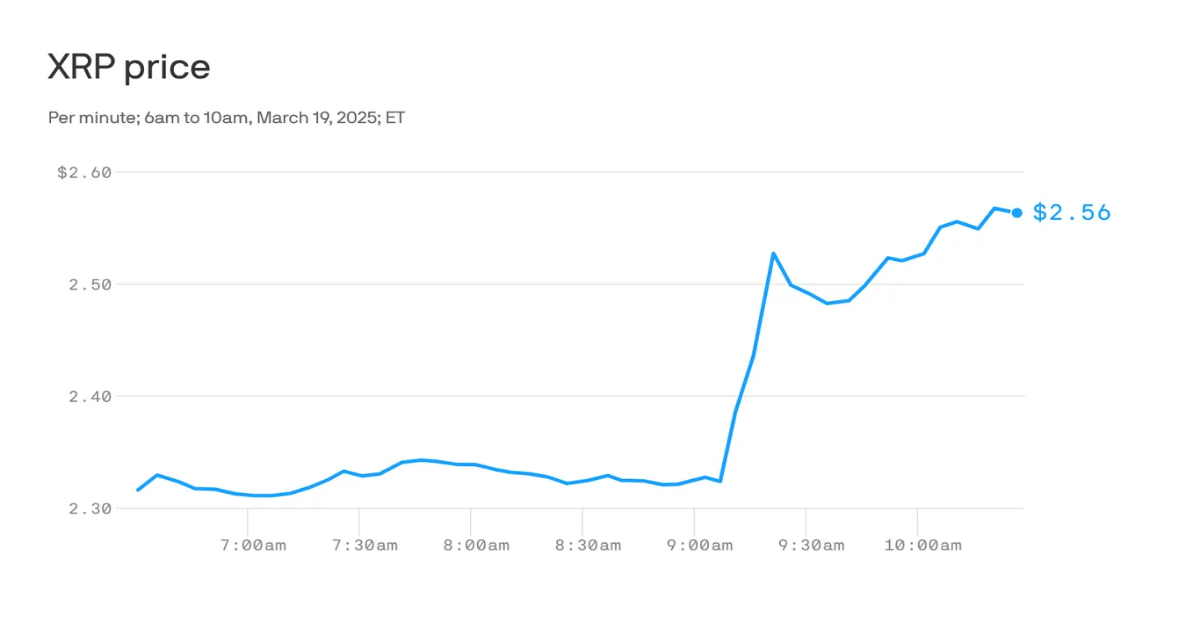

Data: CoinGecko; Chart: Axios Visuals

Ripple CEO Brad Garlinghouse says the SEC will drop a long-running and crucial case over the $150 billion crypto asset xrp.

Why it matters: This has been one of the most watched cases in the digital asset industry, dating back to the final days of the first Trump administration.

The latest: Garlinghouse posted to X that the case was being withdrawn. “This case has ended, it’s over,” he said in a video.

- The SEC has declined to confirm Garlinghouse’s statement to Axios.

Catch up quick: “In so many ways, it was the first major shot fired in the war on crypto,” Garlinghouse says of the case.

- In December 2020, in the final days of the Trump administration, the SEC sued Ripple and two of its executives with conducting an unregistered securities offering.

- The case then marked a major win for the industry in July 2023, when the judge ruled that Ripple’s sales of xrp in the open market were not a securities offering.

This was crucial, because a court was acknowledging that the underlying asset itself was not inherently a security.

Context: Most coverage of cryptocurrencies ask the question: “Are these assets securities or not?” But that’s really the wrong question.

- The question involves whether digital assets share the characteristic of an “investment contract.”

- Attorneys will tell you that assets aren’t really investment contracts. The transactions themselves are the investment contract.

- So just because a transaction with an asset is a security in one instance, doesn’t mean it’s a security in the next transaction.

Zoom out: This issue of the status of the assets became a larger issue over time, with a court permitting a rare interlocutory appeal on the matter in another case, in order to provide precedent across multiple cases.

State of play: The full case closed in Aug. 2024, with Ripple paying a hefty fine on its offering to investors, but not so much that it couldn’t easily proceed as an enterprise.

- Just before the change in administration, however, the SEC filed an appeal.

The big picture: Dropping the Ripple case would be the latest indication that the SEC is charting an entirely new course on crypto regulation.

- While this case started under Trump, it was carried out by the Biden administration. And the new SEC has already sharply changed course on a number of other cases broadly related to the securities question issue.

Market impact: xrp is trading up 10% on the news, currently at $2.55.

What we’re watching: Ripple’s attorney mentioned on X that a cross-appeal the company had filed in the case is still an outstanding matter.

- We have no further details about the particulars of whatever the parties might have agreed to in the closing of the case. Presumably, there will be something brought before the SEC’s commissioners to vote on or a filing before the court.

What’s next: The SEC has a hearing on Friday with the aim that these issues won’t be such open questions and digital asset startups will have rules they can follow.