The Federal Reserve took a wait-and-see approach to an uncertain US economy Wednesday, opting to leave interest rates unchanged at the close of its March meeting.

That decision leaves the benchmark federal funds rate parked at a range of 4.25% to 4.5%, where it has sat since December. The Fed has now stood on the economy’s sidelines for two consecutive meetings, dating to January, after an unusually busy period of interest rate increases and reductions over the previous three years.

The Fed also kept its forecast for two cuts in 2025.

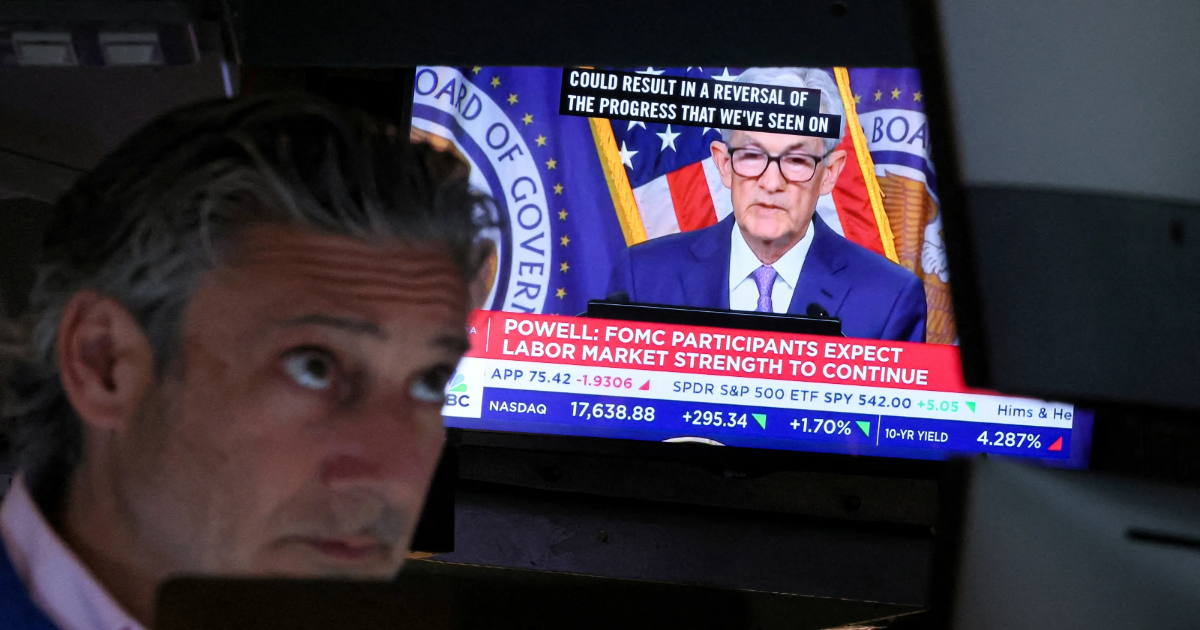

Jerome Powell, the Fed chair, will hold a press conference at 2:30 p.m. Investors and economists will parse his words for commentary on the direction of the US economy.

Wednesday’s Fed meeting Why the Fed faces a dilemma when it comes to interest rate decisions

Need a break? Play the USA TODAY Daily Crossword Puzzle.

How will the Fed respond to tariffs?

Most economists had expected inflation to ease further this year, but President Trump’s tariffs have come sooner and with greater force than many had anticipated. Trump already has imposed a 25% levy on imported steel and aluminum, 20% on all shipments from China and 25% on some goods from Canada and Mexico.

Tariffs scheduled to take effect next month include 25% on remaining imports from Canada and Mexico; 25% on autos, pharmaceuticals and computer chips; and sweeping reciprocal tariffs that would match whatever other countries charge the U.S.

Forecasters at Goldman Sachs expect the levies to drive up inflation by half a percentage point, as retailers and manufacturers pass along their higher costs to consumers. They also anticipate economic growth to diminish as households lose purchasing power.

Goldman predicts the Fed could raise its 2025 inflation forecast from an annual rate of 2.5% to 2.8%. The federal regulators may also lower their annual growth estimate from 2.1% to 1.8%.

– Paul Davidson

How many rate cuts should we expect in 2025?

With economic forces pulling in both directions, several top forecasters expect Fed officials to play it down the middle and forecast two quarter-point rate decreases over the remainder of 2025, a game plan they laid out in December.

But with inflation still elevated and consumers’ inflation expectations rising, some say the central bank could err on the side of caution and reduce its forecast to call for just one rate reduction, potentially generating further market turmoil.

“The (Fed) will face a difficult trade-off between addressing rising inflation and a weakening labor market,” Barclays wrote in a note to clients. “We think the elevated inflation and the surge in… longer-run inflation expectations will prevent the (Fed) from responding aggressively to the softening in economic and labor conditions.”

Barclays figures the Fed will scale back its forecast to a single rate cut. Other observers, including Deutsche Bank, Goldman Sachs and JPMorgan Chase, are still expecting two cuts, but they acknowledge the possibility of only one.

– Paul Davidson

What is stagflation?

Financial experts are increasingly concerned President Donald Trump’s tariffs on goods coming into the United States from other countries could trigger an economic condition known as “stagflation.”

While the president has touted tariffs as a way to offset costs associated with proposed tax cuts, the import taxes come amid a slowdown in economic activity, and at a time of rising costs.

For that reason, some analysts predict tariffs will do more than simply make some consumer goods more expensive. Some business leaders and policymakers fear the conditions could create “stagflation.”

According to Investopedia, stagflation is an economic cycle defined by slow growth, high unemployment and inflation. For the Federal Reserve and other policymakers, stagflation is a tough nut to crack, because “fixing” one problem can potentially make the others worse.

– Eric Lagatta, Marina Pitofsky, Andrea Riquier and Daniel de Visé

Would an interest rate cut in 2025 be bad news?

The Federal Reserve raises and lowers its benchmark interest rate for different reasons. And if the Fed makes any rate cuts later in 2025, economists and analysts will look closely at the central bank’s motivations.

The Fed dialed down interest rates in late 2024 because inflation was coming under control after a period of rising prices. Interest rates had reached a two-decade high, and most observers perceived the cuts as a positive sign.

If the Fed decides to resume cutting rates later this year, however, the reason could be something bad: another inflation surge, the economy slowing, or uncertainty growing.

“While the idea of interest rates coming down is appealing to many consumers and businesses, the reason for lower interest rates is very important,” said Greg McBride, chief financial analyst at Bankrate. “We want interest rates to decline because inflation declines, not because of economic weakness.”

– Daniel de Visé

Why did the Fed stop cutting interest rates?

The Fed chose to reduce its benchmark interest rate three times at consecutive meetings in late 2024, cutting the rate by a full percentage point across those sessions. Then, in January, the central bankers put their rate-cutting campaign on hold.

Why did the Fed stop cutting rates?

The Fed raised interest rates to a two-decade high in 2023 to fight a period of elevated inflation, which peaked in 2022. Then, the central bank lowered interest rates as price increases eased and the nation recovered.

Yet, even as the Fed ordered the last of its 2024 rate cuts in December, the panel forecast a significantly slower pace of cuts in 2025, citing both good and bad economic tidings: lingering inflation coupled with strong economic growth. Essentially, regulators decided interest rates had fallen far enough for the time being.

In that December meeting, the Fed projected only two rate cuts in 2025, down from the four they envisioned in September.

– Daniel de Visé

How is the stock market doing today?

Stock indexes opened in positive territory Wednesday, as investors awaited the latest tidings from the Federal Reserve.

The Dow Jones Industrial Average and S&P 500 were both up about 0.2% shortly after the opening bell. The Nasdaq was up roughly 0.3%.

Forecasters expect the Fed to sit out any interest rate adjustments in its March meeting. And, in a sense, no good is good news: The stock market is notoriously averse to uncertainty.

Even so, traders will be looking for any hints of a positive or negative tone in the Fed’s projections and public comments at the close of the panel’s two-day meeting Wednesday afternoon.

– Daniel de Visé

Is the US headed for a recession?

Not long ago, there was talk that Fed Chair Jerome Powell was steering the economy to a “soft landing,” cooling an overheated economy and bringing inflation under control without sinking the nation into recession.

These days, sentiment has changed. Consumer confidence has plunged. A majority of voters who participated in a recent NBC News poll said they disapprove of President Trump’s handling of the economy. Earlier this month, JP Morgan’s chief economist said there’s a 40% chance of a recession in 2025.

Recession fears are dimming hopes for the soft landing, which seemed all but assured as recently as December.

With the stock market trending downward, Treasury Secretary Scott Bessent said Sunday “there are no guarantees” of the United States escaping a downturn.

– Daniel de Visé and Savannah Kuchar

Is President Trump pressuring the Fed to lower rates?

In his time as president, Donald Trump has not-so-subtly urged the Federal Reserve to cut interest rates to boost the economy.

Shortly after the Fed announced it would not cut rates at its January meeting, Trump lashed out on Truth Social, accusing the regulators of failing “to stop the problem they created with inflation.”

In an earlier speech to the World Economic Forum in Switzerland, Trump said he would “demand that interest rates drop immediately,” remarks that implied he might try to undermine the Federal Reserve’s independence.

When reporters questioned Trump about those remarks, he replied, “I think I know interest rates much better than they do.”

And in a February post, Trump suggested that lower interest rates “would go hand in hand” with his campaign of import tariffs.

– Daniel de Visé

How likely is an interest rate cut at the Fed meeting?

Economic forecasters could not be much more unanimous on this point: Almost no one expects interest rates to change on Wednesday.

A closely monitored FedWatch site shows that 99% of forecasters expect interest rates to go unchanged at the March Fed meeting. No action would leave the benchmark rate at a range of 4.25% to 4.5%.

More than 80% of forecasters expect interest rates to remain where they are in May, the next time the Fed meets.

Most analysts do, however, expect a rate cut by June. Just over half of forecasters expect the benchmark rate to be a quarter-point lower after that meeting.

– Daniel de Visé

If interest rates aren’t changing, does the meeting matter?

Yes. Even if the Federal Reserve takes no action, economic forecasters and investors will hang on every word of Fed Chair Jerome Powell after the central bank announces its interest rate decision.

Powell may lay out where regulators expect the economy to go amid Trump’s escalating trade war. The Fed could make changes to its projections on inflation, the labor market and economic growth. The central bankers could also signal whether they expect to cut interest rates later in the year, and how many times, a crucial piece of news for investors.

Bottom line: Absent a change to the interest rate, everything else the Fed says and does Wednesday takes on greater significance.

– Daniel de Visé