Investors dumped stocks on Wall Street late Monday after President Donald Trump said his threatened tariffs on Canada and Mexico would go forward as planned early Tuesday.

The Dow Jones Industrial Average dropped about 800 points, or 1.8%. The S&P 500 fell 2.1% and was set for its worst day of the year. The tech-heavy Nasdaq Composite slid 3%, weighed down by a separate issue affecting Nvidia, which was already down more than 9%.

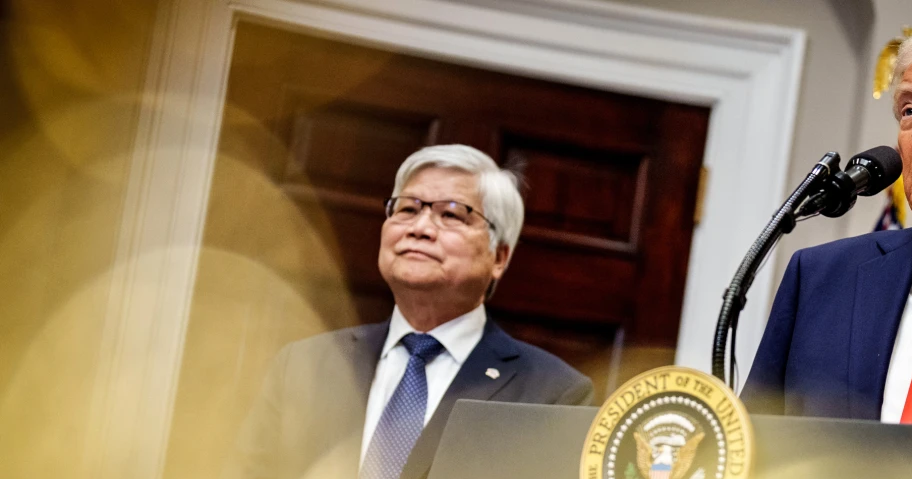

Speaking at the White House alongside Commerce Secretary Howard Lutnick, the president said the clock had run out on finding concessions for America’s two-largest trading partners to avoid sweeping new trade duties.

“No room left for Mexico or for Canada,” Trump said. “Tomorrow, tariffs, 25% on Canada and 25% on Mexico, and that will start.”

He said he’s also imposing an additional 10% tariff on China, on top of the 10% hike he recently instituted, which has already drawn retaliation from Beijing.

Trump also reiterated that previously announced “reciprocal” tariffs would be coming on April 2. And in a post on his Truth Social platform earlier in the day, the president said tariffs on “external product” from the agriculture industry would also be imposed that day, without offering further details.

Even before his remarks, new economic data sounded fresh warnings about the solidity of the U.S. economy. A measure of manufacturing activity showed a jump in suppliers’ costs, sparked in part by trade concerns.

“The incoming tariffs are causing our products to increase in price. Sweeping price increases are incoming from suppliers,” one executive at a machinery firm told the Institute of Supply Management for its monthly survey. “Most are noting increases in labor costs,” a respondent in the machinery sector said.

Monday’s stock market selloff erases a strong start to the year for Wall Street, where many had greeted the onset of the new Trump administration with enthusiasm due to expected deregulation and tax cuts. After rising as much as 5% so far this year, the Dow is now only about 1% higher than where it began 2025.

Already, closely watched signs of consumers’ expectations have softened, and retail sales posted a sharp decline last month. Major brands including Walmart are warning that the new administration’s trade policies could dent their business in the months ahead, although some — such as Chipotle — so far say they plan to eat the expected costs.

Brian Cheung contributed.